“It is not the strongest of the species that survive, but the most adaptable to change.”

– Charles Darwin

In August 2025, the Reserve Bank of India’s FREE-AI framework marked the new era for AI governance in financial services. The Framework for Responsible and Ethical Enablement of Artificial Intelligence in the age of Agentic AI is not only a compliance advantage but also a well-thought-out roadmap in India’s financial sector for the next decade.

Leaders have to remember that it is not another framework to file away. The RBI’s survey data reveals that while 67% of the financial institutions want to explore AI applications, only 20.8% have deployed AI systems. This gap represents both opportunity and risk. Early adopters of the FREE-AI framework will capture the market share, while late adopters risk falling behind competitors and facing regulatory problems.

But beyond the headlines about ethical principles and regulatory compliance lies a more important question: how do leaders actually implement this and turn regulatory requirements into business advantages?

The Seven Sutras: Strategic Principles that will Shape your AI Infrastructure Strategy

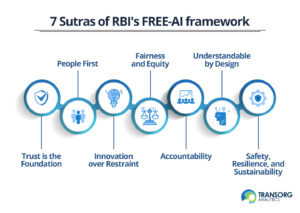

RBI’s FREE-AI framework introduces seven ‘Sutras,’ the core principles to keep in mind when making AI-related decisions. Just as the Sanskrit etymology of the word “sutra”, meaning “thread”, suggests, these principles are to be woven across the entire lifecycle of AI systems.

They are the foundation of the FREE-AI framework and apply to any organization looking to develop, implement, or oversee AI in the Indian financial industry.

- Trust is the Foundation: Since the fraud and risk battle for financial institutions is a big concern, every AI infrastructure deployment must enhance stakeholders’ trust. This principle directly translates into brand value and market position.

- People First: To build strong customer relationships and for liability management, AI systems must ensure that final authority remains with humans, allowing overrides as and when possible.

- Innovation over Restraint: This is one of the most essential principles of the FREE-AI framework for the BFSI sector. Responsible AI innovation rather than excessive restraint must be encouraged to maximize overall benefit and reduce potential harm.

- Fairness and Equity: AI systems must be designed and tested to reduce, not amplify, bias. They must uphold fairness and should not underscore exclusion and inequity because, for financial institutions, this directly impacts regulatory compliance, reputation risk, and market position.

- Accountability: Organizations deploying AI systems should be fully responsible and accountable for the outcomes, regardless of the level of automation.

- Understandable by Design: AI systems must be understandable to deploying organizations. This means that understandability should be a core design feature and not just an afterthought.

- Safety, Resilience, and Sustainability: The last guiding principle of the FREE-AI framework is about AI security. AI systems should be secure, energy efficient, and resilient to infrastructural, physical, and cyber risks. Simply, these systems should have anomaly detection capabilities for banks and other financial institutions to provide early warning signs to avoid harmful outcomes.

The Action Plan: Implementing the Principles

The FREE-AI framework’s real value lies in its 6 strategic pillars, under which RBI has laid out 26 recommendations addressed across the dimensions of innovation enablement and risk mitigation.

Objectives | Focus Areas |

Innovation Enablement | Infrastructure, Policy and Capacity |

Risk Mitigation | Governance, Protection and Assurance |

In order to promote innovation, it suggests:

- creating an AI Innovation Sandbox and establishing a common infrastructure to democratise access to data and compute

- creation of domestic AI models tailored to the banking sector

- creation of an AI policy to offer the required regulatory guidance

- development of institutional capacity at all levels, including the board and employees of REs and other stakeholders

- exchange of best practices and lessons learnt across the financial industry

- a more lenient approach to compliance for low-risk AI solutions to promote inclusion and other priorities

With AI’s increasing impact in banking sector, it suggests the following measures for risk mitigation:

- Regulated Entities (REs) should create a board-approved AI policy

- product approval procedures, consumer protection frameworks, and audits should be expanded to include AI-related elements

- strengthening cybersecurity procedures and incident reporting systems

- creating strong AI governance frameworks throughout the system lifecycle

- making consumers aware when they are interacting with AI

What makes this framework particularly significant is its dual mandate: accelerate innovation while safeguarding systemic stability. This isn’t about choosing between progress and caution; it’s about achieving both simultaneously through structured implementation.

The AI policy implementation roadmap for financial institutions:

1- Short-Term (6-12 months)

Priority Area | Key Actions |

Board-Level Governance |

|

Mandatory Disclosures |

|

Infrastructure Foundation |

|

2- Medium-term (12-24 months)

Priority Area | Key Actions |

Liability Architecture |

|

Audit & Assurance |

|

Indigenous AI Development |

|

How To Convert Compliance Costs Into Competitive Business Advantages

Now for the question that matters most to C-suite leaders like you: how organizations can actually implement the RBI’s FREE-AI framework for their business advantage, here’s the answer:

The first step for the leading financial organizations and industry leaders is to view this framework as a competitive opportunity, not just cost centres. The FREE-AI’s recommendations create multiple advantageous opportunities:

1- Enhanced Regulatory Relationship: Proactive compliance and open communication ensured enhanced trust and reputation. This results in quicker approvals for new products, collaborative problem-solving, and a stress-free environment.

2- Talent Magnet Effect- The framework’s emphasis on ethical AI attracts professionals who appreciate purpose-driven work. Clear AI governance frameworks become recruitment and retention strategies in competitive talent markets. Build your organization’s market position as a leader in responsible AI deployment, create internal AI impact assessments that give technologists a voice, and invest in continuous learning programmes.

3- Increased Trust- Due to the skepticism related to AI, demonstrated ethical leadership fosters customer loyalty. Businesses that can convey their AI governance transparently will attract risk-sensitive customers, institutional partners seeking compliant suppliers, and socially conscious investors.

4- Infrastructure Leverage- Early involvement with the FREE-AI framework’s emphasis on Digital Public Infrastructure creates opportunities for shared resources, access to subsidized capabilities, and reaping network effects.

5 Important Risk Management Considerations in RBI’s FREE-AI Framework

Some of the important risks that the framework identifies include:

1- Algorithmic Bias at Scale: The framework warns about bias amplification across high-volume transactions, such as in credit risk models. A slight bias, multiplied across millions of applications, results in a massive regulatory exposure. To ensure safety, your organization must implement continuous bias monitoring across all AI touchpoints.

2- Model Concentration Vulnerability: Excessive dependence on comparable AI models reduces market diversity and produces associated failure modes. Your organization must diversify its AI approach and maintain in-house capabilities even when using vendors.

3- Third-Party Service Dependencies: The framework highlights the organizational liability created due to service interruptions and non-compliance by third-party AI providers. Your organization must enhance vendor due diligence, demand contractual assurances about audits and explainability, and maintain contingency capabilities.

4- Regulatory Non-Adoption Risk: Interestingly, the framework highlights the danger of not implementing AI. Delaying implementation will put organisations at a long-term competitive disadvantage and create issues with inclusiveness. The strategic question isn’t whether to deploy AI, but how to do so responsibly.

5- Explainability & Black-Box Systems: AI systems that cannot explain their decisions, such as why a loan application was rejected or a transaction was marked as suspicious, create unacceptable governance and regulatory risks and reduce trust. For deployment of responsible AI, reject solutions that lack explainability, regardless of performance, and build audit trails that document how AI reaches conclusions.

Who does FREE-AI Framework apply to?

The FREE-AI framework applies to all regulated entities (REs) in the Indian financial system by RBI, including:

- Non-banking financial companies (NBFCs)

- Scheduled commercial banks

- Payment system operators (PSOs)

- All India financial institutions

- Fintech companies and other innovators

The Road Ahead for AI & Regulation in India’s Fintech Landscape

With RBI’s FREE-AI framework in the system, in the coming years, we’re likely to see:

1- Cross-border Regulatory Alignment: As a G20 member, India is aligning with international AI ethics frameworks. The FREE-AI’s “7 Sutras” align closely with global AI principles of transparency, accountability, and human oversight.

2- Acceleration of Indigenous AI Models: India-specific AI models trained on local financial data, regulatory requirements, and market conditions will outperform generic global solutions. Initiatives such as the IndiaAI Mission are funding the development of indigenous models, whereas DPDPA and RBI data localization requirements make India-specific models more practical than global alternatives requiring cross-border data transfers.

3- Responsible Innovation as a Competitive Advantage: In India’s crowded fintech landscape, trust is scarce. Consumers & investors are more likely to engage with AI-powered services from companies that provide clear, understandable explanations of how their AI systems work and how decisions are made.

4- Change in Talent & Hiring Priorities: Fintechs and banks will seek experts who combine domain expertise with AI literacy. The need for new roles such as AI compliance specialists and AI ethics specialists is emerging due to the requirement of non-negotiable safe and secure AI apps.

Final Words

The RBI’s FREE-AI framework aligns with the Indian government’s IndiaAI Mission, launched in March 2024, which aims to make India a global leader by building a robust AI ecosystem. The framework provides regulatory clarity in the emerging technology domain for Indian financial organizations, creating actionable opportunities for the industry leaders.

In the age of Agentic AI for CEOs and senior-level management, the strategic imperative is clear: AI adoption is not optional; but how you adopt determines your competitive position and regulatory relationship.

Organizations that will embed the framework’s recommended principles into culture, governance, and operations will define the next era of financial services, and late adopters will miss its strategic value and face regulatory pressure. So, the question isn’t whether the FREE-AI framework will reshape your organization. It’s whether you’ll lead that reshaping or react to it.

Implementing the RBI’s FREE-AI policy requires strategic vision, technical capability, and regulatory insight. TransOrg Analytics brings all three. Our expertise in AI governance, fraud & risk analytics, and regulatory compliance positions us uniquely to guide your FREE-AI implementation. Connect with us today to navigate this approach from initial gap assessment to full operational maturity.

FAQs:

Is AI adoption mandatory under RBI’s FREE-AI?

According to the FREE-AI framework, AI adoption is not mandatory, but it makes clear that any AI systems used must follow responsible practices. The framework outlines expectations for governance, consumer protection, transparency, and assurance, ensuring your AI deployment is fair, responsible, and accountable in the coming times.

What is Responsible AI in the financial sector?

Responsible AI in the financial sector means developing and using AI ethically, with a focus on trust, fairness, transparency, and accountability. It is guided by the core principles outlined in FREE-AI’s report, including safety, people-first, trust, privacy, and non-discrimination.

Does RBI FREE-AI restrict the use of AI in banks and NBFCs?

No. The FREE-AI framework does not restrict AI usage but provides guardrails to help institutions scale AI safely while maintaining compliance, trust, and consumer protection.

What happens if banks do not align with the FREE-AI framework?

Increased regulatory scrutiny, operational risk, reputational harm, and possible limitations on AI-led decision-making systems might result from nonalignment with the RBI’s FREE-AI framework.

How does FREE-AI affect third-party or vendor AI solutions used by banks?

FREE-AI affects third-party or vendor AI solutions used by banks by requiring that these external solutions must follow the same stringent governance, risk management, and ethical standards as internal AI systems. This means institutions need strong vendor due diligence, clear documentation of model logic and data usage, ongoing performance and bias monitoring, and the ability to intervene or override AI decisions when required.