If you are a fintech, NBFC, cooperative bank, or CPG leader and are planning to deploy this model, you are about to face the most critical question from your partners, regulators, or board: “Who validated this?”

3 Critical Gaps That Make Technically Sound Ml Models Fail In Production

As enterprises race to deploy ML models for competitive advantage, three critical gaps emerge consistently:

-

The Documentation Gap:

Decisions are made on the fly as models are constructed iteratively. By the deployment time, the ‘why’ behind data transformations, feature engineering, and hyperparameter selections is limited to Slack threads and someone’s memory.

-

The Bias Blind Spot:

Development teams optimize for predictive performance. They rarely have the capacity or sometimes expertise to conduct rigorous fairness testing across proxy variables and protected classes.

-

The Deployment Disconnect:

Due to minute implementation variations in variable computations or data pipelines, the model works smoothly in Python notebooks but behaves differently in production systems.

Any of these gaps can derail your model. All three together? That’s not a risk but an inevitability. And this is why ML model audit is not just a need but a necessity.

What Enterprises Actually Need from ML Model Audit & Validation

Contrary to popular belief, ML model audit guidelines are not a compliance checklist but are meaningful answers to three fundamental questions:

- Transparency: Can you explain every decision the model makes? Not just aggregate feature importance, but individual prediction reasoning suitable for customer disputes.

- Fairness: Have you statistically demonstrated that your model does not discriminate on the basis of proxies or protected characteristics?

- Governance: Is it possible for an independent party to replicate your findings? Are there safeguards against model drift or unauthorised changes?

Conventional ML model audits frequently check compliance boxes without these aspects being verified. They may confirm that you computed the AUC accurately but fail to notice that a customer segment that will be present in production was consistently left out of your training data.

Therefore, the machine learning model audit you need is not a checklist. It’s a structured approach to knowing whether your model will perform reliably, fairly, and accurately when real money and real people are involved.

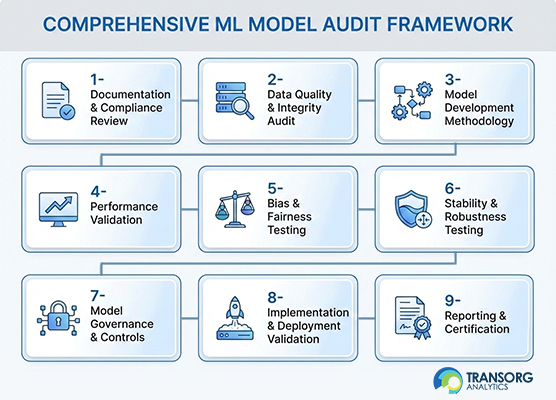

The Framework of a Comprehensive ML Model Audit

Here’s what rigorous validation actually looks like:

Now we often hear, ‘Why does speed matter in model audit, and how do we achieve it?’ The answer is simple.

The traditional ML model validation and audit timeline is 2-3 months. For fast-moving enterprises, that’s an eternity because markets shift, competitors launch and partnership opportunities expire. But wrong validation is worse than delaying deployment. A failed audit after 2-3 months is frustrating.

The Real Cost of Skipping ML Model Audit and Validation

Organizations skip rigorous validation for understandable reasons, such as it being expensive, slowing deployment, and internal teams believing that their work is solid.

But consider the alternative costs:

- Regulatory intervention after deployment forces model withdrawal, remediation, and often penalties.

- Partnership failures such as in banks happen when they refuse to work with unvalidated models. Cooperative banks especially, given their risk profile and regulatory guidelines, demand third-party certification before onboarding fintech partners.

- Portfolio deterioration from model weaknesses surfaces slowly. By the time higher-than-expected default rates appear, the damage is already done.

- Technical debt occurs when governance gaps allow documented model changes, version control failures, or monitoring lapses. A few months later, no one remembers why certain decisions were made.

Validation is not an obstacle to deployment. It’s insurance against these scenarios, each of which costs more than the ML model audit itself.

What Great ML Model Audit Services Look Like In Practice

The best machine learning model audits make them better, helping clients:

- Know hidden insights: Independent validators often discover model strengths and identify variables that could improve performance further.

- Position their model for regulatory compliance: The detailed & comprehensive reviews and processes for testing fairness provide a necessary defensible position in case of any future regulatory review.

- Operational readiness: Implementing best governance practices will transition your currently ad hoc model management practices into the ongoing processes necessary to maintain lending operations as it grows.

Next Steps

If you are currently deploying, or intend to deploy, an ML-based lending model, you should consider the following:

- Did you test for fairness across all relevant customer segments, such as for proxy discrimination?

- Are these controls preventing unauthorized changes or detecting drift?

- Does your model maintain performance under economic stress scenarios?

If you are uncertain about any of these, ML model audit and validation is not optional but essential.

Enterprises across industries are increasingly relying on ML and agentic AI for business operations and decisions. It’s true that agentic AI and ML solutions offer genuine advantages in customer targeting, demand forecasting, fraud detection, pricing optimization, quality control, or risk scoring. However, the realization of this opportunity only materializes with validation of ML models to ensure they perform reliably, fairly and transparently.

TransOrg Analytics comes with extensive experience and provides proven ML model audit services that allow global enterprises to quickly generate validated ML credit risk models for continuous business operations and growth. Connect with us today to discuss your unique model validation and audit requirements and timelines and get started!

FAQs about ML Model Audit

1. What is an ML model audit?

An ‘ML model audit’ and validation is a systematic process of a model to evaluate its performance, fairness, safety, and data integrity to ensure that it operates as intended. The model validator investigates the entire life cycle of a model to detect risks such as bias, security, model drift, and vulnerabilities.

2- How is ML model testing different from model validation?

In general, model testing focuses on performance metrics, whereas model validation includes the evaluation of the entire lifecycle, including feature engineering, security, fairness, deployment, and consistency.

3- Which industries need ML model audit and validation?

Any industry using ML for decision-making regarding demand forecasting, quality control, anomaly detection, etc., can benefit. The list includes financial services, CPG/retail, healthcare, manufacturing, telecom, etc.

4- How long does a comprehensive ML model audit take?

With a structured framework, automation and required data, a rigorous ML model audit can be completed in 28-30 days without compromising quality.

5- What are the benefits of ML model audit and validation?

ML model audits help prevent bias, unfair outcomes, regulatory non-compliance, performance drift, deployment failures, and technical debt caused by undocumented or uncontrolled changes.